This site uses functional cookies and external scripts to improve your experience.

If you want to know more or deny consent to all or some cookies click the following link you will find our extended information on cookies and an explanation on how to disable cookies on the major browsers.

Avvocatidiimpresa with Agreen Capital for the acquisition of BiotoBio

Avvocatidiimpresa, Gitti and Partners and Gpbl in the sale of BiotoBio to Probios – Legal Community

Probios, an Italian company specialized in healthy food, with the support of Agreen Capital, has acquired the entire share capital of BiotoBio, Company belonging to the EcorNaturaSì group and leader in the marketing of organic, healthy and free-form food products. PFC Family Office and Amundi have joined Agreen Capital as co-investors.

The acquired perimeter includes, among others, the brands Baule Volante, Finestra sul Cielo and Fior di Loto.

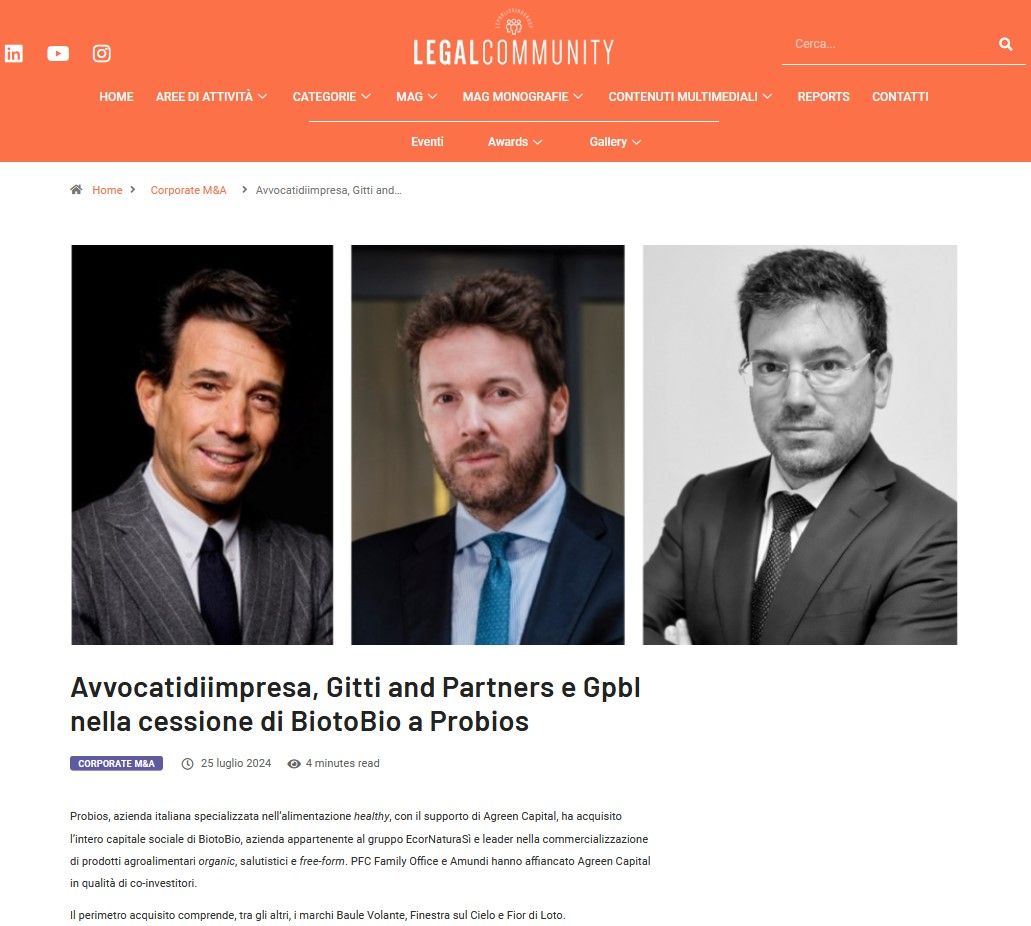

Together with managing partner Alberto Calvi di Coenzo (pictured left), Probios was assisted in all aspects of the acquisition.

Gitti and Partners, with a team led by managing partner Vincenzo Giannantonio and partner Giacomo Pansolli (pictured on the right), together with senior associate Giovanna Vecchio and associate Vera Greco for corporate aspects, from partner Flavio Monfrini for commercial aspects, by associate Daniele Rositani Conti for real estate aspects and partner Domenico Patruno for banking aspects, he assisted EcorNaturaSì and the minority partners in the sale of BiotoBio, and EcorNaturaSì in reinvestment in Probios.

Gatti Pavesi Bianchi Ludovici (GPBL) assisted a pool of financial institutions including BPER Corporate & Investment Banking, which also acted as an agent bank, and UniCredit, also as sustainability coordinator, with a team composed of equity partner Marc-Alexandre Courtejoie (pictured in the middle) with the counsel Stefano Motta and the associate Luca Serino.

Probios was assisted by Agreen Capital for M&A advisory activities, by EY, with partner Andrea Cacciapaglia and senior manager Gabriele Cardella, as financial advisor, from EY Parthenon, with the partners Alessio Agostinelli, Paolo Dambruoso and the manager Valeria Fusi, for the activities of Business Due Diligence and Business Planning, by Epyon Consulting for the Financial Due Diligence and the Fiscal Due Diligence by Studio Sebastiani with the founding partner Alessandro Sebastiani and the partners Edoardo Lattuada and Tommaso Franzini.

The sellers were assisted, as financial advisor, by Vitale&Co, with a team composed of managing partner Alberto Gennarini, partner Valentina Salari, by vice president Salvatore Celozzi and analyst Gabriele Iovene and by Ways Advisory, with a team composed of partner Leopoldo Varasi, by associate partner Paolo Giovanetti and manager Gianluca Raimondi.

100% of BiotoBio spa (Ecornaturasi) was taken over by Probios spa (Agreen Capital), a transaction financed by BPER, Unicredit and CDP – BeBeez

The entire ownership of one of the first operators who have bet on organic in Italy is passed.

The 100% of BiotoBio spa, most of which is owned by Ecornaturasi spa, was in fact taken over by Probios spa, controlled since March 2023 by Agreen Capital, Company based in Lugano and offices in Amsterdam that organizes club deals in the agro-food sector and food tech European (see other BeBeez article). Amundi sgr, on behalf of the fund Amundi ELTIF AgrItaly Pir, had participated in the financing of the deal in question.

The two operators have also worked together in this case. Amundi, in fact, together with PFC Family Office has joined Agreen Capital as co-investors and, in particular, Amundi sgr has increased its support to the project through a participation in equity by the Amundi Private Equity Funds Italy and Amundi Eltif AgrItaly PIR, have made the companies known (see press release here).

BPER, Unicredit and Cassa Depositi e Prestiti financed the acquisition whose value has not been disclosed. The deal was not disclosed to BeBeez, who contacted the parties.

Advisors for Probios were Agreen Capital, for M&A advisory activities, EY, as financial advisor, and EY Parthenon for Business Due Diligence and Business Planning activities. Instead, they acted Epyon Consulting, for the Financial Due Diligence, and Sebastiani Studio for the Fiscal Due Diligence. The firm Avvocati has assisted Probios in all legal aspects, while Gatti PavesiBianchiLudovici has assisted the pool of banks for the structuring of financing.

The sellers were assisted, as financial advisors, by Vitale&Co and Ways Advisory.

Gitti and Partners was the advisor to the sellers in all legal aspects.

BiotoBio was born from the meeting of two companies, Fior di Loto, founded in 1972, and Baule Volante, in 1987, among the pioneers of organic in Italy, which first allied themselves strategically and then merged to create BiotoBio srl. In 2021, La Finestra sul Cielo was added, which includes packaging, production and distribution facilities for organic products and has been operating in the organic food market since 1978. This is explained by the BiotoBio’s Linkedin profile, in which all three brands have entered the sale.

As for the results, in 2023 the company generated 71 million euros of revenues, 6.3 million ebitda, with 8.2 million net debts (see here the report of Leanus, after registering for free).

Andrea Rossi, President of Probios and managing partner of Agreen Capital said: “this acquisition represents the main M&A transaction of the year in the Food Health & Wellness sector, It allows the Probios group to exceed the threshold of 100 million euros in turnover in just over a year and considerably strengthens the positioning of the group within the reference market with The integration of high-quality and high-potential brands. We are now looking to further industrial and international acquisitions.’

Renato Calabrese, CEO of Probios said: “We are proud to have created a pan-European group that puts nutrition, well-being and sustainability at the centre of its mission. We set ourselves the objective of enhancing an extraordinary brand heritage for quality, innovation capacity and connection with the agricultural and production chain made-in-Italy. The coming months will see us strongly committed to the implementation of our ambitious strategic plan which includes the consolidation of our national and international commercial presence and simultaneously, strengthening the Group’s industrial footprint”.

Fausto Jori, CEO of EcorNaturaSì, echoed the statement: “Our company intends to focus its efforts on the sales channel of stores that belong to the NaturaSì ecosystem. This new operation contributes to the creation of a strategic business-to-business hub for the distribution of historic Italian brands, with a focus on the horeca, in the channels with strong prevalence salutistica and abroad. Synergy that will improve efficiency in the development of new products, in the sourcing of raw materials and the consequent support to agricultural production, The European Commission has published a report on the situation in the Member States of the European Union.

Since 1978, the year of its foundation, Probios has been offering a wide range of organic food products- The company, which is based in Florence, is present in 43 countries around the world including Germany, The company is represented by its subsidiary (Probios Deutschland).

The group markets about 420 gluten-free products, of which about 170 are provided by the National Health System, while more than 140 are products without milk, Many also without yeast and free from.

Probios closed 2022 with 25.7 million revenues, 1 million ebitda and net debt of almost 1.6 million (see here the report by Leanus, after registering for free). As participations, it has 15% of the company Il Nutrimento srl and 1% of European Organic Partners.

Agreen Capital: ‘free from’ move, acquired Biotobio – Dealflower

Probios with Agreen Capital goes healthy and definitely aims to go far in organic food. In fact, the Italian company specialized in healthy and controlled nutrition of the club deal Agreen Capital, has acquired 100% of the share capital of Biotobio. In Probios enters the company of the ecosystem Ecornaturasì and active in the marketing of organic, healthy and free-from food products.

The co-investors

The acquisition’s co-investors include Pfc Family Office and Amundi. In particular, Amundi Sgr, already a Probios financier, increases its support for the project through an equity participation. And it does so with the funds Amundi Private Equity Italia and Amundi Eltif AgrItaly Pir. A pool of banks – consisting of Bper, Unicredit and Cassa Depositi e Prestiti – financed the operation. The acquired perimeter includes, among others, the brands Baule Volante, Finestra sul Cielo, Fior di Loto and Vivibio. EcorNaturaSì will be a minority partner of the new business.

Probios, a bit of history

Probios is active in healthy, free from and organic food, it is based in Calenzano and is present in 47 countries around the world. For over 45 years, it has been offering exclusively organic food, using mainly Italian raw materials and clean label and free-from lines, ideal for those who follow specific food styles (gluten free, protein, vegan, sugar free, nickel free). In 2021, Probios decided to adopt the benefit company model by declaring in its statutes its commitment, beyond any business opportunity, The European Commission has published a report on the impact of EU research on the environment.

Biotobio, the sketch

Biotobio, based in Bologna and Villareggia, brings together the experience of three pioneering companies in the health sector in Italy. They are the lotus flower, the flying trunk and the window to the sky, By uniting and sharing their intentions and strategic vision, they have strengthened their position on the market by increasing the quality and efficiency of the services offered.

Ecornaturasì

Ecornaturasi manages directly or in franchising over 320 sales outlets in Italy dedicated only to the sale of organic and biodynamic products. The company was founded in 1985 and, during these years, has developed a network of 300 farms cultivated with the biological and biodynamic method. The majority share is held by a non-profit foundation whose purpose is to protect the corporate mission according to international steward-ownership principles.

The advisor

Probios was assisted by Agreen Capital for its M&A advisory activities, and Ey – with partner Andrea Cacciapaglia and senior manager Gabriele Cardella – as financial advisor, Ey parthenon – with partners Alessio Agostinelli, Paolo Dambruoso and manager Valeria Fusi – for business due diligence and business planning activities – Epyon Consulting for the two financial filigence and for the tax due diligence the Studio Sebastiani with the founding partner Alessandro Sebastiani and the partners Edoardo Lattuada and Tommaso Franzini. The firm Avvocati, together with managing partner Alberto Calvi di Coenzo, assisted Probios in all legal aspects.

The Gatti PavesiBianchiLudovici firm assisted the pool of banks in structuring the financing. The sellers were assisted, as financial advisor, by Vitale&Co with a team composed of managing partner Alberto Gennarini, partner Valentina Salari, by vice president Salvatore Celozzi and analyst Gabriele Iovene and Ways Advisory with a team composed of partner Leopoldo Varasi, by associate partner Paolo Giovanetti and manager Gianluca Raimondi. Gitti and Partners, with managing partner Vincenzo Giannantonio, together with partners Giacomo Pansolli and Flavio Monfrini, Senior associate Giovanna Vecchio and associates Daniele Rositani and Vera Greco, assisted the sellers in all legal aspects.

Probios acquired 100% di Biotobio: the advisor – Finance Community

Probios, an Italian company specialized in healthy food, with the support of Agreen Capital, acquires 100% of the share capital of Biotobio, Company belonging to the ecosystem EcorNaturaSì and leader in the marketing of organic, healthy and free-from food products.

PFC Family Office and Amundi are working alongside Agreen Capital as co-investors, in particular, Amundi SGR, which is already a sponsor of Probios, renews and increases its support for the project through a participation in equity by Amundi Private Equity Funds Italia and Amundi Eltif AgrItaly PIR.

A pool of banks – consisting of BPER, Unicredit and Cassa Depositi e Prestiti – financed the acquisition.

The acquired perimeter includes, among others, the brands Baule Volante, Finestra sul Cielo, Fior di Loto and Vivibio.

THE ADVISOR

Probios was assisted by Agreen Capital for its M&A advisory activities, and EY – with partner Andrea Cacciapaglia and senior manager Gabriele Cardella – as financial advisor, EY Parthenon – with partner Alessio Agostinelli, Paolo Dambruoso and the manager Valeria Fusi – for business due diligence and business planning activities, Epyon Consulting for financial due diligence and tax due diligence the Sebastiani Studio. The firm Avvocati has assisted Probios in all legal aspects.

The firm of Gatti Pavesi Bianchi Ludovici assisted the pool of banks in structuring the financing.

The sellers were assisted, as financial advisor, by Vitale with a team composed of managing partner Alberto Gennarini, partner Valentina Salari, by vice president Salvatore Celozzi and analyst Gabriele Iovene and Ways Advisory with a team composed of partner Leopoldo Varasi, by associate partner Paolo Giovanetti and manager Gianluca Raimondi. Gitti and Partners has assisted the sellers in all legal aspects.

In the photo, from left to right: Alberto Gennarini, Valentina Salari and Salvatore Celozzi; below: Andrea Cacciapaglia, Alessio Agostinelli and Paolo Dambruoso.

DECLARATIONS

The operation – defined by the management of Probios “transformational”, is part of the strategic plan of Probios and Agreen Capital to consolidate a leading pole in Europe in the field of organic, healthy and free-from food. EcorNaturaSì will be a minority partner of the new business.

Andrea Rossi, President of Probios and managing partner of Agreen Capital, states: “This acquisition represents the main M&A transaction of the year in the Food Health & Wellness sector, It allows the Probios group to exceed the threshold of 100 million euros in turnover in just over a year and considerably strengthens the positioning of the group within the reference market with The integration of high-quality and high-potential brands. The standing of the participants participating in the project and the high interest found confirm a transversal focus on sustainability, ESG and consumer health, The Bank’s investment strategy is based on a number of key elements. We are now looking to further industrial and international acquisitions.’

Renato Calabrese, managing director of Probios says: ‘We are proud to have created a pan-European group that puts nutrition, well-being and sustainability at the heart of its mission. We set ourselves the objective of enhancing an extraordinary brand heritage for quality, innovation capacity and connection with the agricultural and production chain made-in-Italy. The coming months will see us strongly committed to the implementation of our ambitious strategic plan which includes the consolidation of our national and international commercial presence and simultaneously, strengthening the Group’s industrial footprint”.

Fausto Jori, CEO of EcorNaturaSì, says: “Our company intends to focus its efforts on the sales channel of stores that belong to the NaturaSì ecosystem. This new operation contributes to the creation of a strategic business-to-business hub for the distribution of historic Italian brands, with a focus on the horeca, in the channels with strong prevalence salutistica and abroad. Synergy that will improve efficiency in the development of new products, in the sourcing of raw materials and the consequent support to agricultural production, The European Commission has already published a report on this subject. Another step towards what is for us a mission, that is the spread of the culture of organic”.

Probios acquires 100% of BiotoBio (EcorNaturaSì group) – Aziendabanca

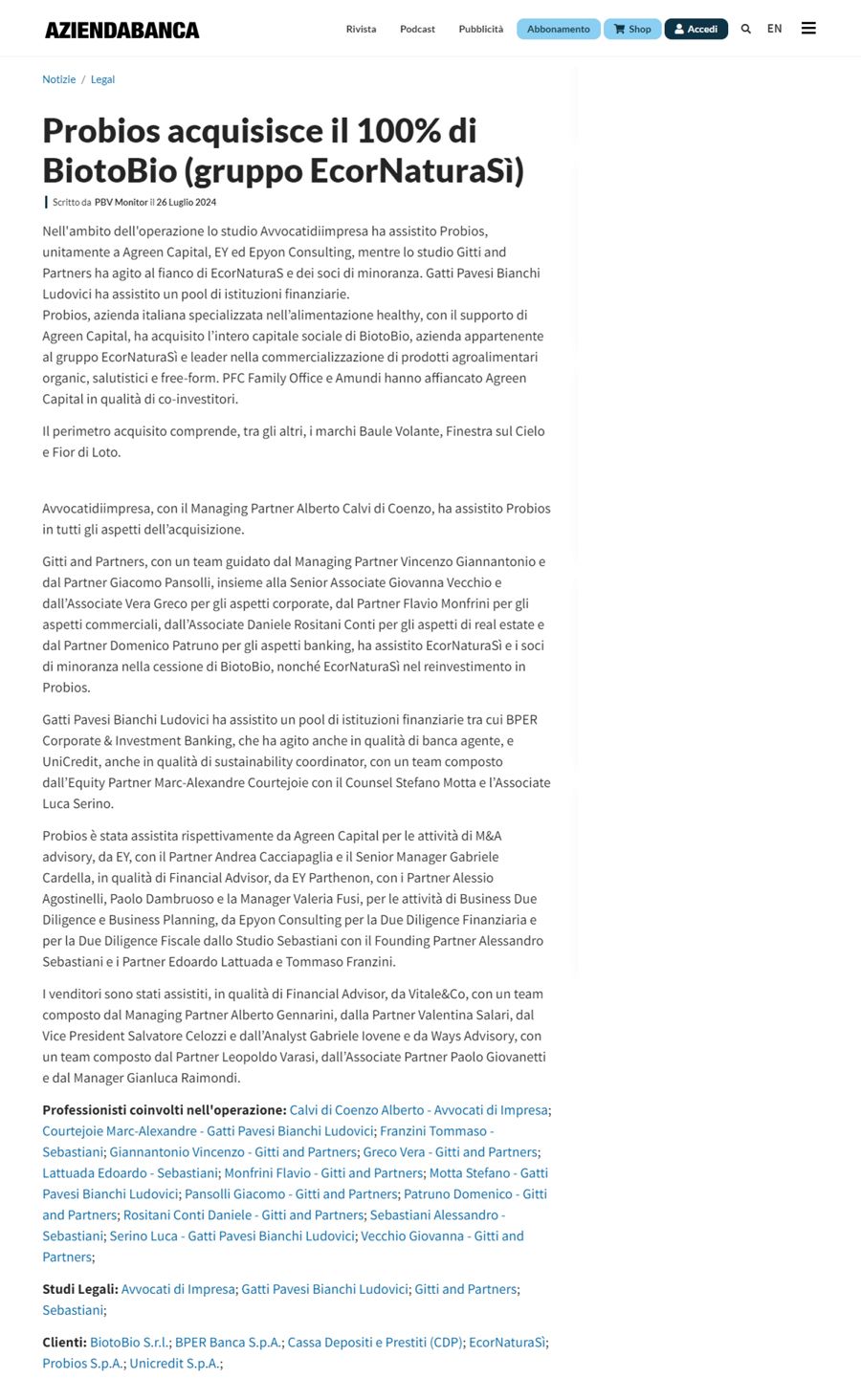

In the context of the operation, the firm Enciclopedia Impresa assisted Probios, together with Agreen Capital, EY and Epyon Consulting, while the firm Gitti and Partners acted alongside EcorNaturaS and minority shareholders. Gatti Pavesi Bianchi Ludovici assisted a pool of financial institutions.

Probios, an Italian company specialized in healthy food, with the support of Agreen Capital, has acquired the entire share capital of BiotoBio, a company belonging to the EcorNaturaSì group and leader in the marketing of organic agri-food products, Health and free-form. PFC Family Office and Amundi have joined Agreen Capital as co-investors.

The acquired perimeter includes, among others, the brands Baule Volante, Finestra sul Cielo and Fior di Loto.

The Company, with Managing Partner Alberto Calvi di Coenzo, has assisted Probios in all aspects of the acquisition.

Gitti and Partners, with a team led by Managing Partner Vincenzo Giannantonio and Partner Giacomo Pansolli, together with Senior Associate Giovanna Vecchio and Associate Vera Greco for corporate aspects, by Partner Flavio Monfrini for commercial aspects, Associate Daniele Rositani Conti for real estate aspects and Partner Domenico Patruno for banking aspects, assisted EcorNaturaSì and minority partners in the sale of BiotoBio, as well as EcorNaturaSì in reinvesting in Probios.

Gatti Pavesi Bianchi Ludovici assisted a pool of financial institutions including BPER Corporate & Investment Banking, which also acted as bank agent, and UniCredit, also as sustainability coordinator, with a team composed by the Equity Partner Marc-Alexandre Courtejoie with Counsel Stefano Motta and Associate Luca Serino.

Probios was assisted by Agreen Capital for M&A advisory activities, by EY, with Partner Andrea Cacciapaglia and Senior Manager Gabriele Cardella, as Financial Advisor, by EY Parthenon, with Partners Alessio Agostinelli, Paolo Dambruoso and the Manager Valeria Fusi, for the activities of Business Due Diligence and Business Planning, by Epyon Consulting for the Financial Due Diligence and the Fiscal Due Diligence by Studio Sebastiani with Founding Partner Alessandro Sebastiani and Partners Edoardo Lattuada and Tommaso Franzini.

The sellers were assisted, as Financial Advisor, by Vitale&Co, with a team composed of Managing Partner Alberto Gennarini, Partner Valentina Salari, Vice President Salvatore Celozzi and Analyst Gabriele Iovene and Ways Advisory, with a team composed of Partner Leopoldo Varasi, Associate Partner Paolo Giovanetti and Manager Gianluca Raimondi.

Avvocatidiimpresa, Gitti and Partners and Gatti Pavesi Bianchi Ludovici in the sale of BiotoBio (EcorNaturaSì group) to Probios – NT+ Diritto (IlSole24ore)

Probios has acquired the entire share capital of BiotoBio, a company belonging to the EcorNaturaSì group and leader in the marketing of organic, healthy and free-form food products. Probios, an Italian company specialized in healthy food, with the support of Agreen Capital, has acquired the entire share capital of BiotoBio, a company belonging to the EcorNaturaSì group and leader in the marketing of organic agri-food products, Health and free-form. PFC Family Office and Amundi have joined Agreen Capital as co-investors.

The acquired perimeter includes, among others, the brands Baule Volante, Finestra sul Cielo and Fior di Loto.

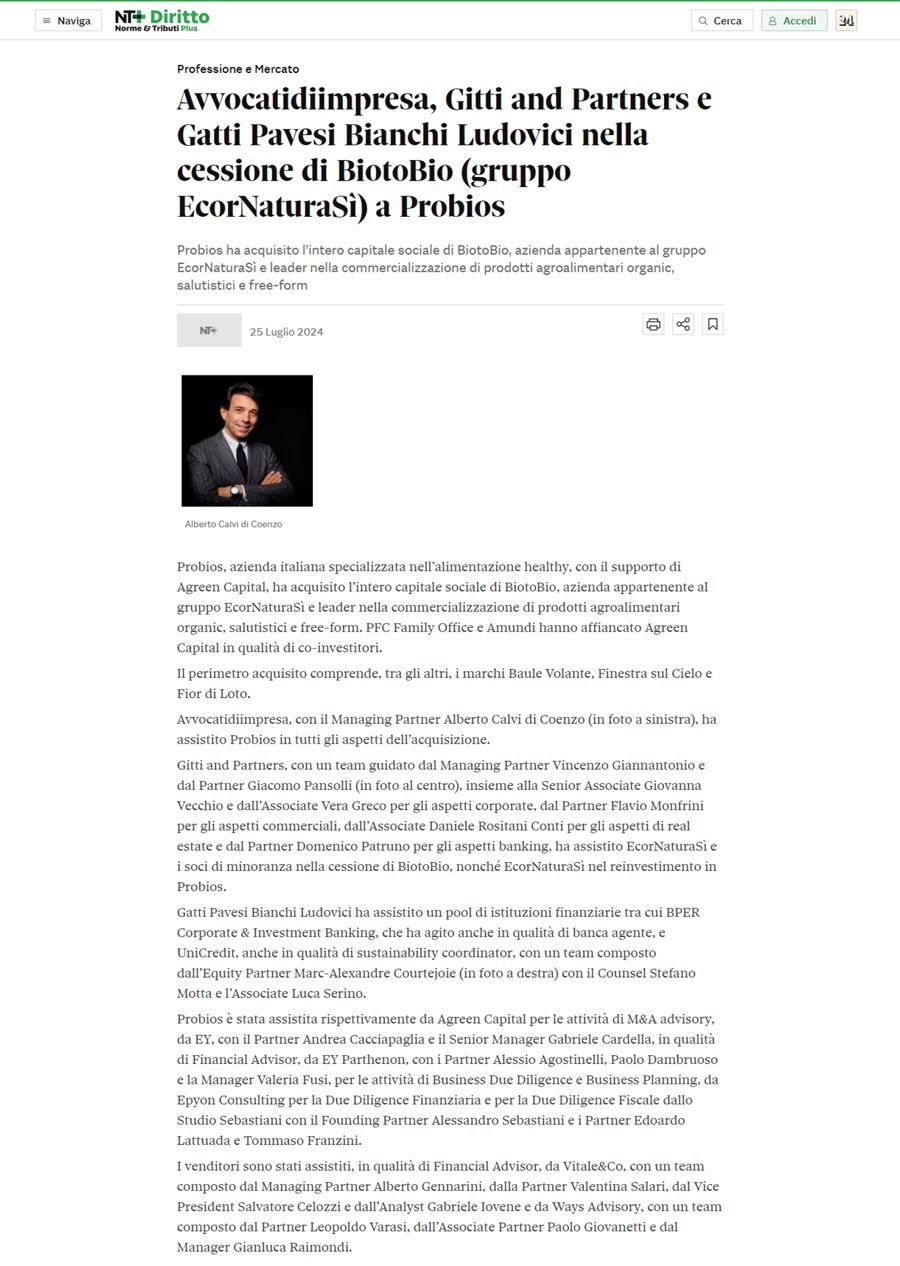

The company, with Managing Partner Alberto Calvi di Coenzo (pictured left), assisted Probios in all aspects of the acquisition. Gitti and Partners, with a team led by Managing Partner Vincenzo Giannantonio and Partner Giacomo Pansolli (pictured in the middle), together with Senior Associate Giovanna Vecchio and Associate Vera Greco for corporate aspects, Partner Flavio Monfrini for commercial aspects, Associate Daniele Rositani Conti for real estate aspects and Partner Domenico Patruno for banking aspects, assisted EcorNaturaSì and the minority partners in the sale of BiotoBio, and EcorNaturaI in reinvesting in Probios. Gatti Pavesi Bianchi Ludovici assisted a pool of financial institutions including BPER Corporate & Investment Banking, which also acted as bank agent, and UniCredit, also as sustainability coordinator, with a team composed by the Equity Partner Marc-Alexandre Courtejoie (pictured right) with Counsel Stefano Motta and Associate Luca Serino.

Probios was assisted by Agreen Capital for M&A advisory activities, by EY, with Partner Andrea Cacciapaglia and Senior Manager Gabriele Cardella, as Financial Advisor, by EY Parthenon, with Partners Alessio Agostinelli, Paolo Dambruoso and the Manager Valeria Fusi, for the activities of Business Due Diligence and Business Planning, by Epyon Consulting for the Financial Due Diligence and the Fiscal Due Diligence by Studio Sebastiani with Founding Partner Alessandro Sebastiani and Partners Edoardo Lattuada and Tommaso Franzini. The sellers were assisted, as Financial Advisor, by Vitale&Co, with a team composed of Managing Partner Alberto Gennarini, Partner Valentina Salari, Vice President Salvatore Celozzi and Analyst Gabriele Iovene and Ways Advisory, with a team composed of Partner Leopoldo Varasi, Associate Partner Paolo Giovanetti and Manager Gianluca Raimondi.

Probios acquires 100% of Biotobio – Adnkronos

The Tuscan company will control the brands Baule Volante, Finestra sul Cielo, Fior di Loto and Vivibio. Turnover will exceed €100 million by the end of the year.

Probios, an Italian company specialized in healthy food, with the support of Agreen Capital, announces that it has finalized the acquisition of 100% of the share capital of Biotobio, Company belonging to the EcorNaturaSì ecosystem and leader in the marketing of food, health, free-from and organic products. The scope of acquired brands includes among others: Flying Trunk, Window on the Sky, Lotus Flower and Vivibio.

The operation – defined by the management of Probios “transformational” – is part of a strategic plan that aims to consolidate a leading pole in Europe in the health, free-from and organic sector. “This acquisition, which represents the main M&A transaction of the year in the Food Health & Wellness sector, allows Probios to exceed the threshold of 100 million euros in turnover in just over a year and considerably strengthens the group’s position within the target market thanks to the integration of high-quality brands with great potential”, comments Andrea Rossi, President of Probios and Managing Partner of Agreen Capital. “The standing of the project participants and the high interest they have received confirm a cross-cutting focus on sustainability, ESG and consumer health: key elements of our investment strategy”.

“We are proud to have created a pan-European group that puts nutrition, well-being and sustainability at the centre of its mission,” adds Renato Calabrese, CEO of Probios. “We set ourselves the objective of enhancing a heritage of extraordinary brands for quality, innovation capacity and connection with the agricultural and productive chain “made in Italy”. The coming months will see us strongly committed to the realization of our ambitious strategic plan that includes the consolidation of our national and international commercial presence”.

The Tuscan company has recently revolutionized its visual identity with a new logo and graphic design, to give even more value to the shopping experience of over 850 references signed Probios. Conosciuta per i suoi claim all’avanguardia come il “nichel free” e il “senza zuccheri aggiunti”, le linee low carb “Keto” e “protein” – che si affiancano al “gluten free”, per cui l’azienda vanta la più vasta offerta di referenze sul mercato -, Probios uses mainly Italian raw materials, from a controlled chain to obtain references of plant origin of the highest quality, based on a sustainable agronomic system that respects soil and biodiversity.

Probios is now a central reality in the world of nutrition that, leveraging on the most representative brands of organic in Italy, is destined to become leader of the most virtuous companies in the sector and spokesperson of made in Italy in Europe and overseas. The stakes are ambitious: become a reference player of healthy nutrition, conquering an increasingly transversal target that winks not only to those who have always been aware of the importance of eating healthy, but also to the purchasing managers more sensitive to environmental issues, which in recent years have increasingly approached products that combine taste, well-being and green attitude.

Probios, the leading Benefit company in Italy for healthy, free of and organic food, is based in Calenzano, a few kilometers from Florence and is present in 47 countries around the world. For over 45 years, it has been offering exclusively organic food using predominantly Italian raw materials, with product lines with a highly healthy content, clean label and free-from, ideal for those who follow specific food styles (gluten free, protein, vegan, sugar free, nickel free). The company also combines the research and selection of high-quality organic raw materials with attention to balance and originality in recipes. The result obtained together with the wide range of products, guarantees its consumers balanced and tasty, able to satisfy the most demanding palates. In 2021, Probios decided to adopt the Benefit Company model by declaring in its Statute “its commitment, beyond any business opportunity, to generate a positive impact for Man and the Planet in which he lives”.